Bank Of Canada Cbdc Privacy

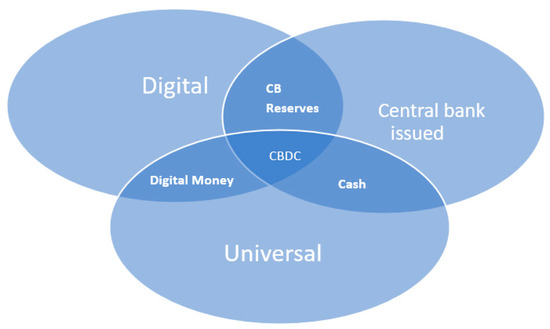

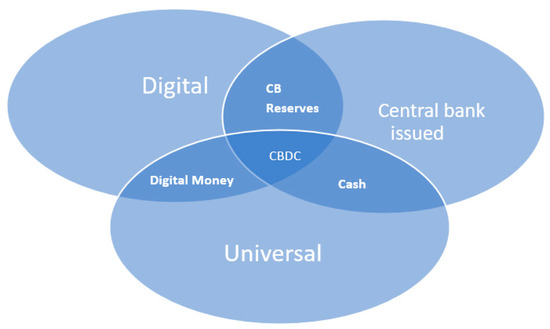

We discuss the competition and innovation arguments for issuing a central bank digital currency CBDC. It also outlined the pros and cons of zero knowledge proofs.

Central Bank Digital Currency Cbdc In Depth Guide

While some argue that a CBDC could allow more complex transfer schemes or the ability to break below the zero lower bound we find these benefits might be small or difficult to realize in practice.

Bank of canada cbdc privacy. OTTAWA May 26 Reuters - The Bank of Canada is thinking in more concrete terms. While a central bank digital currency could be used in place of cash that doesnt mean it would have the exact same characteristics as cash. A CBDC could be an effective competition policy tool for payments.

Andreas Veneris Andreas Park Fan Long and Poonam Puri February 11 2021 A. There will be no stopping them. Any central bank-issued digital currency should have limits on how much anonymity it gives users a senior Bank of Canada official argues.

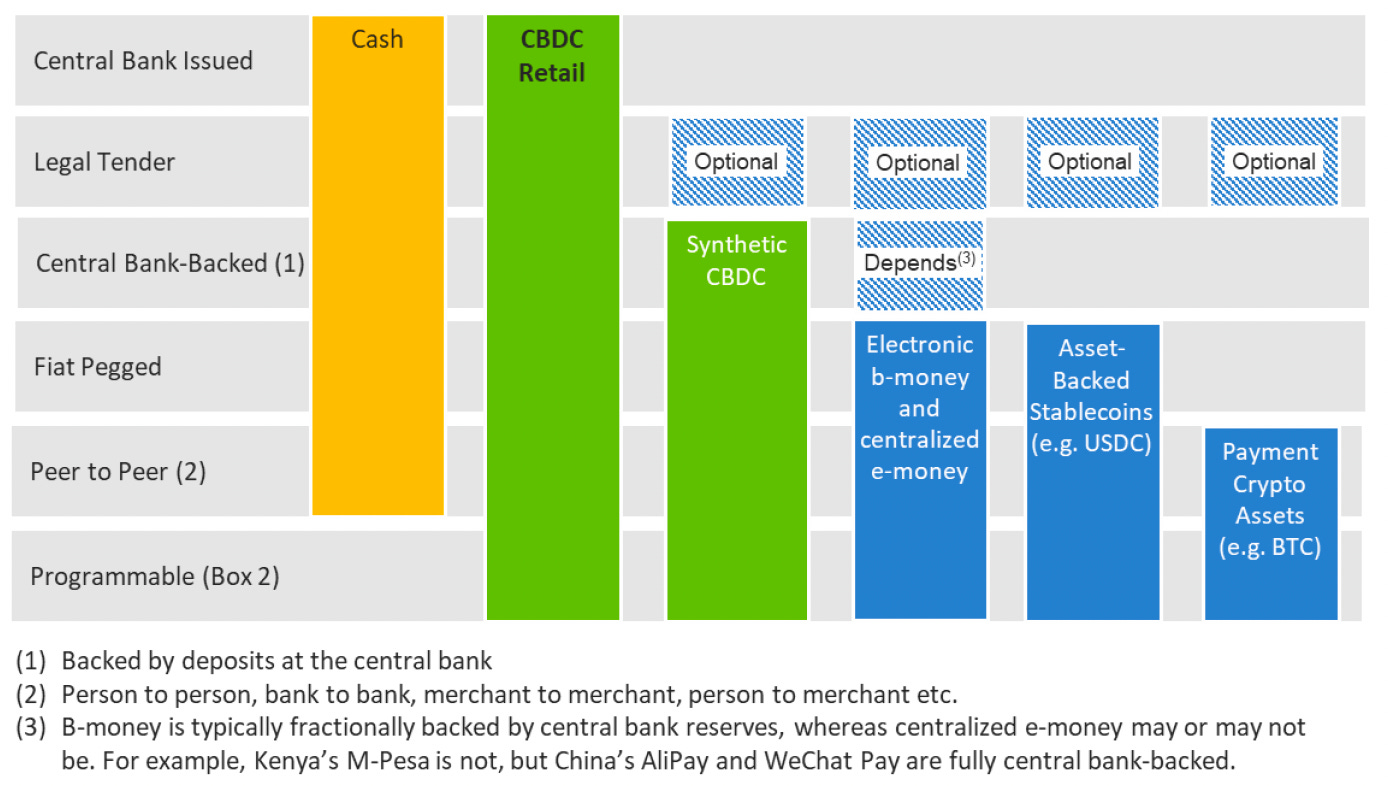

Although private currencies were mentioned stablecoins were not the focus. The Bank of Canada has been exploring and building capacity for products like a central bank digital currency CBDC but there has been no specific time. This note outlines what is technologically feasible for privacy in a central bank digital currency CBDC system.

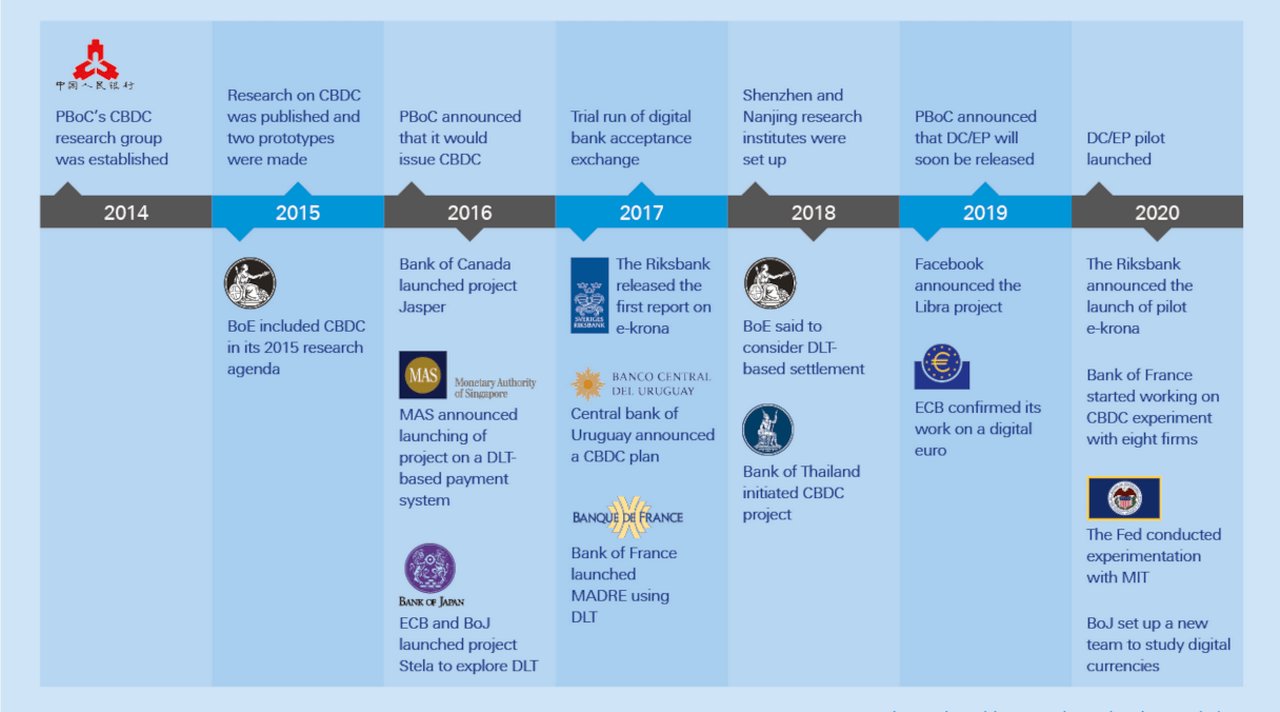

From Sweden to Thailand and China to Canada. Canadian Cash for a New Global Economy. In 2020 Bank of Canada BoC ran a university competition the Model X Challenge to design a hypothetical central bank digital currency CBDC.

The Banks Deputy Governer committed to making their CBDC greener than bitcoin Currently bitcoin mining uses more energy worldwide each year than the Netherlands. Canadas focus on monetary sovereignty echoes that of other countries working on or considering a CBDC. Speaking to Central Banking in a forthcoming interview deputy governor Timothy Lane says there would need to be a trade-off in terms of.

A CBDC could also support the vibrancy of the digital economy. Now Timothy Lane a deputy governor of the Bank says the pandemic may have accelerated some of the necessary preconditions for a potential CBDC. Objectives for a retail CBDC in Canada The Bank of Canada has signalled its intentions to develop a retail CBDC in Canada in several short working papers public addresses and through participation in collaborative discussions with1 2 other central banks while at the same time making clear that there is currently no compelling3 case to issue a CBDC 4.

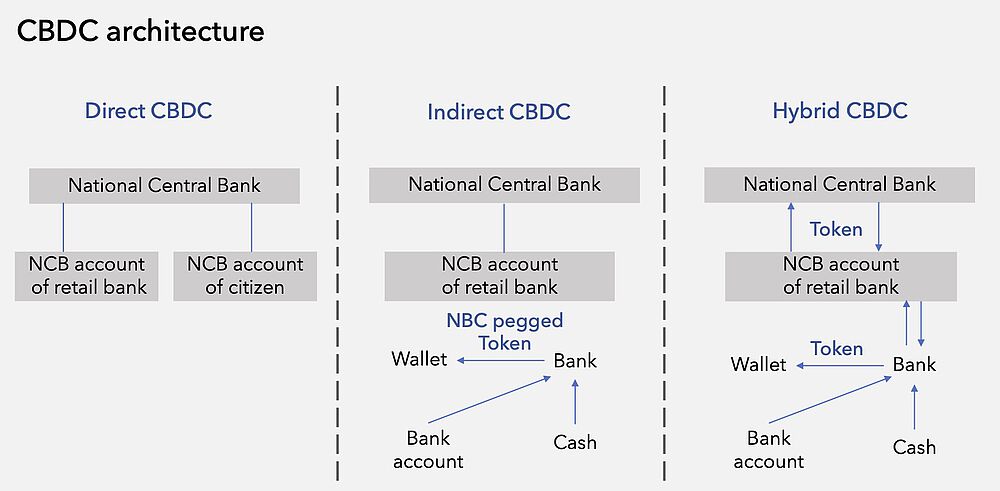

Like hate or fear them central bank digital currencies CBDCs are on their way. All three approaches suggest an account-based solution although two of them additionally advocate for a. The Bank of Canada said earlier this year it wasnt planning to implement a digital currency any time soon.

CBDCs are often described by advocates as replacements for inconvenient unsanitary cash in a post-COVID world. The Bank of Canada is no doubt part of countries looking at adopting its own CBDC. This note highlights the required security properties of a CBDC system and the challenges encountered with existing solutions should the Bank of Canada choose to issue one.

Bank of Canada research has established that there is a public good aspect to privacy in payments Garratt and van Oordt 2019. The Bank of Canada issued a new staff analytical note analyzing the risks of issuing a CBDC. Canada and crypto regulations.

Bank of Canada does not currently see strong case for issuing CBDC. Bank of Canada CBDC to Be of Less Harm to Environment Than Bitcoin Deputy Says. The bulk of the succinct paper highlights the trade offs between privacy which is seen as a public good and the need for disclosure required by regulations.

It could help solve market failures and foster competition and innovation in new digital payments markets. Veneris is with the University ofTorontos Department Electrical and Computer Engineer-. The Bank of Canada is continuing to push toward the release of a central bank digital currency.

Not your keys not your crypto is a rallying cry for the. Improving the conduct of monetary policy is unlikely to be the main motivation for central banks to issue a central bank digital currency CBDC. The Bank of Canada is embarking on a program of major social significance to design a contingent system for a CBDC which can be thought of as a banknote but in digital form the bank.

Final Report for the Bank of Canadas Model X Challenge. The bank planned to develop one only as a contingency should the need arise. Security is an important element in ensuring public confidence in a central bank digital currency CBDC.

The Bank of Canada has published a staff analytical note exploring privacy for central bank digital currencies CBDC. Despite this recent report released by the Bank of Canada the countrys CBDC development is still largely focused on considering the projects feasibility with the most recent update from the researchers stating the CBDC will not include Zero-Knowledge-Proofs. CBDCs cannot have unlimited privacy Canadian deputy governor.

Canadas CBDC would be centralized thereby be under banks control and the institution will be able to regulate transactions in the network. If we go beyond the Canadian payments market what are the risks associated with retail CBDCs including regulation and legislation between geographies consumer protection and trust and financial stability. However when Facebook first unveiled Libra now Diem this seemed to spur an acceleration of Chinas research into central bank digital currency and the country has since warned against stablecoins.

The authors believe the government should look at liability in the case of token loss. This is to curb threat decentralized crypto pose after several years. It analyzes the risks of users holding their own tokens or entrusting them to third-party services.

How the Bank of Canada is Faring Among its Peers. Financial privacy with CBDCs vs cash. Central Bank Digital Loonie.

The Bank of Canada has signalled that a CBDC would co-exist with existing payment instruments like cash rather than to serve as a full replacement if implemented.

Central Bank Digital Currencies And The Digital Euro Cash Infra Pro

Digital Currencies Differing Motives Deutsche Bank

Joitmc Free Full Text Central Banks Digital Currency Detection Of Optimal Countries For The Implementation Of A Cbdc And The Implication For Payment Industry Open Innovation Html

Central Bank Digital Currency Cbdc Is Not A Cryptocurrency By Jagdish Klever News

Digital Disruption The Inevitable Rise Of Cbdc Suerf Policy Notes Suerf The European Money And Finance Forum

Overview Of Central Bank Digital Currency State Of Play Suerf Policy Notes Suerf The European Money And Finance Forum

Overview Of Central Bank Digital Currency State Of Play Suerf Policy Notes Suerf The European Money And Finance Forum

Pandemic Accelerates Bank Of Canada S Cbdc Work

Digital Currencies Differing Motives Deutsche Bank

Complete Guide To Cbdc Central Bank Digital Currency 101

Cbdc Part 1 The What And Why By Joachim Klement Klement On Investing

Cbdc Research Landscape Download Scientific Diagram

Overview Of Central Bank Digital Currency State Of Play Suerf Policy Notes Suerf The European Money And Finance Forum

Complete Guide To Cbdc Central Bank Digital Currency 101

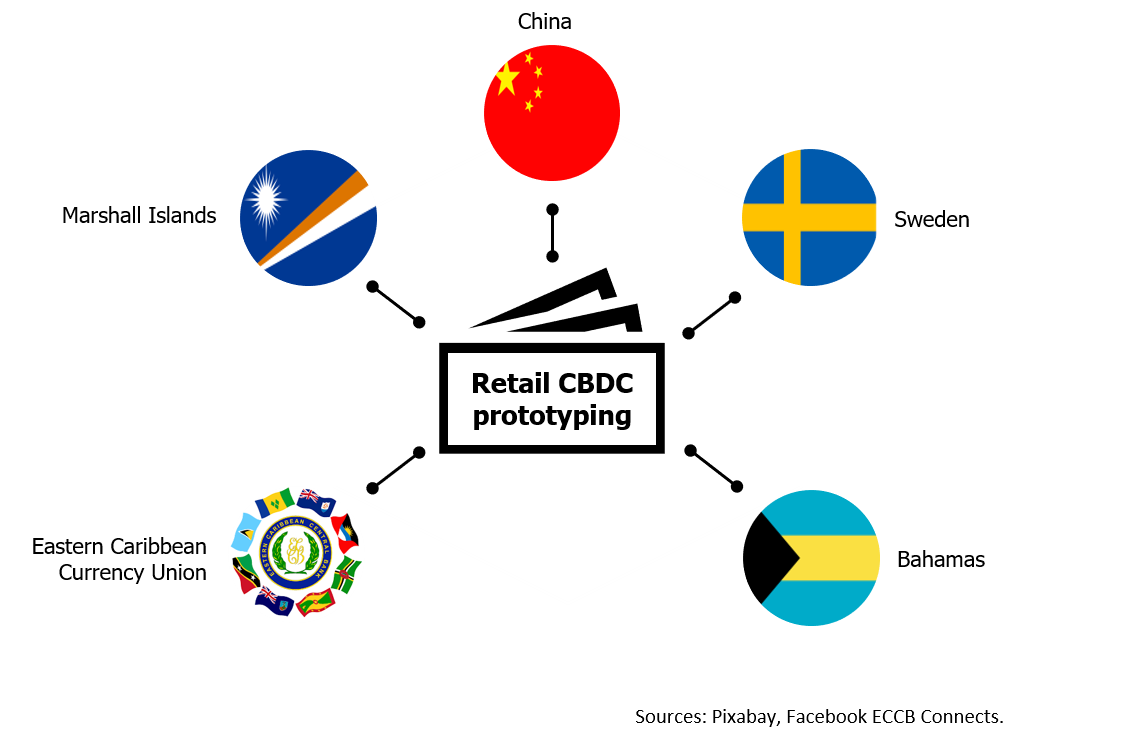

Cbdc Pioneers Which Countries Are Currently Testing A Retail Central Bank Digital Currency By Jonas Gross Medium

Ga Cbdc System Generic Framework Download Scientific Diagram

How To Create Central Bank Digital Currency Cbdc Over Xinfin Xdc Network Xinfin

Central Bank Digital Currencies The Game Changers Deutsche Bank